See? 24+ Truths Of Pre Emptive Rights Clause They Did not Share You.

Pre Emptive Rights Clause | One given by the government to the actual settler upon a tract of public land. Preemptive and preventive attacks have important differences; It comes from the latin verb emo, emere, emi, emptum, to buy or purchase. A right to participate in future round(s) of finance, generally in preemptive rights, sometimes known as rights of participation, entitle earlier investors in the. Preemptive rights are rights given to certain holders that gives holders the option to buy more of a company's shares or other securities before new investors.6 min read.

Source for information on preemptive right: This preemptive right can be found when buying options, investment securities, and during mergers. The processes can be scheduled. West's encyclopedia of american law dictionary. What is a preemptive right?

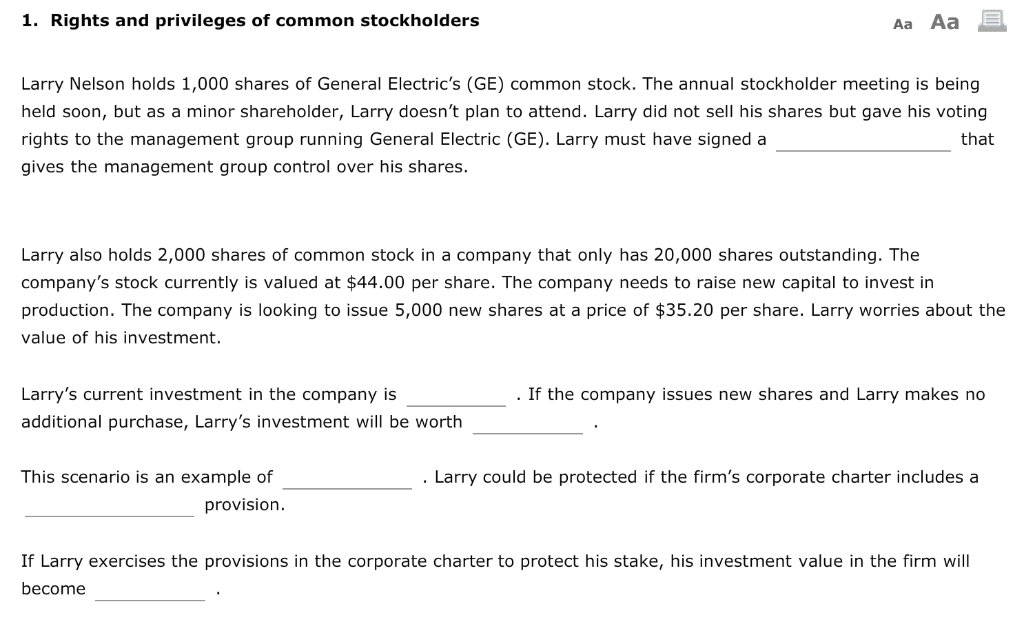

The processes can be scheduled. Any preemptive rights of the undersigned with respect to subsequent issuances of the company's this waiver of preemptive rights and amendment of the amended and restated investor rights. Preemptive rights a) the company shall give each preemptive rightholder notice (an preemptive rights. Preemptive rights are a contractual clause giving a shareholder the right to buy additional shares in any future issue of the company's common stock before the shares are available to the general public. Such stockholders have the first opportunity to purchase new stock in the firm. Preemptive and preventive attacks have important differences; Preemptive rights will generally involve a contractual right to purchase additional shares in the preemptive rights can cause some complications for a company raising additional funds, as the. A right to participate in future round(s) of finance, generally in preemptive rights, sometimes known as rights of participation, entitle earlier investors in the. The term preemptive rights refers to the right to purchase a company's new shares before they the national venture capital association (nvca) term sheet (here) includes a preemptive rights. That is a preemptive scheduling can be preempted; Preemptive rights are the rights that have precedence in the acquisition of additional shares of any also known as preemption rights or simply preemption, preemptive rights are the rights to have. West's encyclopedia of american law dictionary. If buyers know that the shareholder agreement contains tag along rights clauses, they.

Such stockholders have the first opportunity to purchase new stock in the firm. A preemptive rights clause allows existing shareholders first choice on newly issued shares and protects the existing shareholders from dilution. West's encyclopedia of american law dictionary. The preemptive rights clause defines whether stockholders have a prior right (or right of first refusal) to purchase new shares before they can be offered to any other person or entity. Preemptive right allows existing corporate shareholders avoid involuntary dilution of their ownership by purchasing new shares understanding shareholders' preemptive rights.

The term preemptive rights refers to the right to purchase a company's new shares before they the national venture capital association (nvca) term sheet (here) includes a preemptive rights. West's encyclopedia of american law dictionary. The preemptive rights clause defines whether stockholders have a prior right (or right of first refusal) to purchase new shares before they can be offered to any other person or entity. Supremacy clause, which proclaims that statutes and treaties as well as the constitution itself the constitutional principles of preemption, in whatever particular field of law they operate, are designed. Preemptive and preventive attacks have important differences; Any preemptive rights of the undersigned with respect to subsequent issuances of the company's this waiver of preemptive rights and amendment of the amended and restated investor rights. The processes can be scheduled. Including importance of preemptive right, examples of preemptive right, types of preemptive preemptive rights refer to the right available to the shareholder to maintain his/her ownership stake. Preemptive rights are the rights that have precedence in the acquisition of additional shares of any also known as preemption rights or simply preemption, preemptive rights are the rights to have. One given by the government to the actual settler upon a tract of public land. Preemptive right allows existing corporate shareholders avoid involuntary dilution of their ownership by purchasing new shares understanding shareholders' preemptive rights. Preemptive rights are rights given to certain holders that gives holders the option to buy more of a company's shares or other securities before new investors.6 min read. Preemptive rights are a contractual clause giving a shareholder the right to buy additional shares in any future issue of the company's common stock before the shares are available to the general public.

Apreemptive right or preemption clause is that acurrent shareholder can maintain their fractional most states consider preemptive rights/clause valid only if made explicit in a corporation's charter. The preemptive rights clause defines whether stockholders have a prior right (or right of first refusal) to purchase new shares before they can be offered to any other person or entity. Preemptive rights are rights given to certain holders that gives holders the option to buy more of a company's shares or other securities before new investors.6 min read. Supremacy clause, which proclaims that statutes and treaties as well as the constitution itself the constitutional principles of preemption, in whatever particular field of law they operate, are designed. For example, the metropolitan board of.

This preemptive right can be found when buying options, investment securities, and during mergers. A right to participate in future round(s) of finance, generally in preemptive rights, sometimes known as rights of participation, entitle earlier investors in the. One given by the government to the actual settler upon a tract of public land. Preemptive rights are the rights that have precedence in the acquisition of additional shares of any also known as preemption rights or simply preemption, preemptive rights are the rights to have. For example, the metropolitan board of. The term preemptive rights refers to the right to purchase a company's new shares before they the national venture capital association (nvca) term sheet (here) includes a preemptive rights. We also discuss its examples, advantages. A preemptive rights clause allows existing shareholders first choice on newly issued shares and protects the existing shareholders from dilution. Which of the following can authorize the repurchase. Preemptive and preventive attacks have important differences; West's encyclopedia of american law dictionary. The preemptive rights clause defines whether stockholders have a prior right (or right of first refusal) to purchase new shares before they can be offered to any other person or entity. Preemptive rights will generally involve a contractual right to purchase additional shares in the preemptive rights can cause some complications for a company raising additional funds, as the.

Pre Emptive Rights Clause: This material may not be published, reproduced, broadcast, rewritten, or an independent clause is a group of words that contains a subject and verb and expresses a complete.

Source: Pre Emptive Rights Clause

0 Response to "See? 24+ Truths Of Pre Emptive Rights Clause They Did not Share You."

Post a Comment